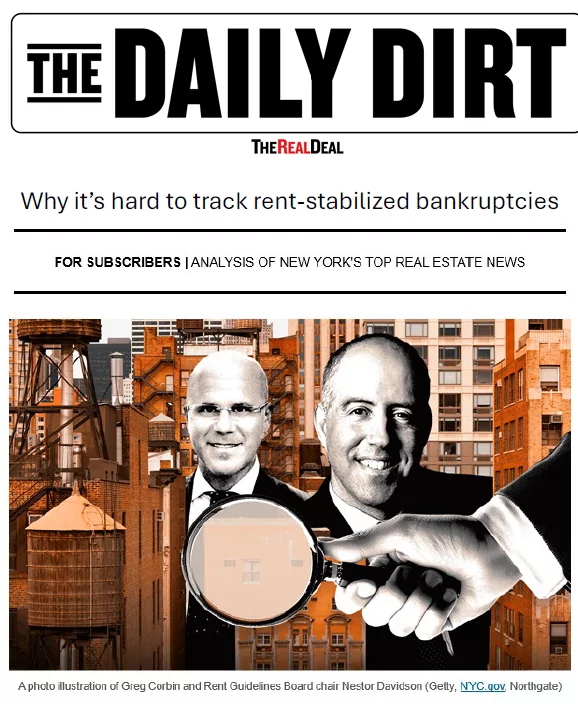

I asked Greg Corbin, whose firm markets bankruptcy sales, if he’s seeing a lot of business from rent-stabilized properties. “We’re getting hired on these every week or two and it’s going to get far busier in 2025,” he said. “We’re on the market with a dozen of them and have half a dozen in contract.”

It stands to reason that bankruptcies are becoming more frequent for rent- stabilized buildings, because interest rates for new loans are much higher than for expiring ones, and operating expenses have outstripped rent revenue for this asset class since the 2019 rent law passed.

But it would be nice to have data to see what’s actually happening with rent-stabilized bankruptcies. The city’s Rent Guidelines Board and state’s Division of Homes and Community Renewal don’t appear to track them.

Doing so would require checking bankruptcy filings against the RGB’s list of properties.

Unfortunately for landlords, the mission of these agencies is not to prevent rent-stabilized bankruptcies. Although the Rent Guidelines Board monitors the financing environment, it does not count debt service when it calculates operating expenses.

Some tenant advocates consider that appropriate. In their view, if mortgage payments put a building into the red, it means that the owner borrowed too much against it, and that the market will reset the value when it is sold in foreclosure.

Some commentators blithely state that owners would not have to worry about interest rates if they just paid for buildings in cash. Which is kind of like saying tenants wouldn’t have to worry about making the rent if they just paid for the entire lease up front.

This is not to say that bankruptcies must be prevented. As former astronaut Frank Borman famously said, capitalism without bankruptcy is like Christianity without hell. If someone overpays for a building, he or his lender will eventually have to swallow a loss so the property’s finances can be stabilized.

Owners of rent-stabilized buildings don’t disagree. Their argument is that the drastic changes to the law in 2019 were wholly unpredictable if not unconstitutional, and have been compounded by a run-up in operating costs that far exceeded the rent increases they have been allowed.

While that debate rages on, Greg Corbin’s phone keeps ringing.